Economic Development

1100 East Monroe Street, Brownsville, TX 78520, Rm 112

ECONOMIC DEVELOPMENT

504 SBA LOAN PROGRAM

Ramiro Aleman, Economic Development Director

(956) 550-1370

Ramiro.Aleman@co.cameron.tx.us

Daniela Sosa, BLDC/SBA 504 Loan Program Director

(956) 546-4020

Daniela.Sosa@co.cameron.tx.us

Jaydy Valdez, Economic Development Office Specialist

(956) 544-0828

Jaydy.Valdez@co.cameron.tx.us

Cynthia Garza, BLDC/SBA Loan Officer

Cynthia.Garza@co.cameron.tx.us

Desiree Sordia, SBA Loan Servicing Specialist

(956) 546-4020

Desiree.Sordia@co.cameron.tx.us

Economic Tools & Incentives

We Offer

Abatement

Reinvestment Zone

(TIRZ)

Exemption

Zones

Agreements

State Economic

Incentives

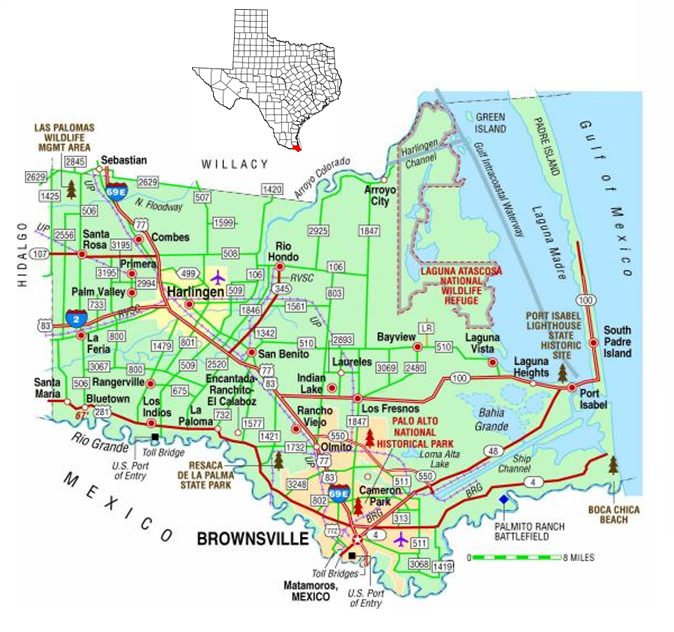

CAMERON COUNTY DEMOGRAPHICS

2018 Population Estimate

423,908

| 1. Brownsville | 183,392 |

| 2. Harlingen | 65,436 |

| 3. San Benito | 24,385 |

| 4. Los Frenos | 7,883 |

| 5. La Feria | 7,328 |

| 6. Port Isabel | 5,055 |

| 7. Primera | 4,989 |

| 8. Laguna Vista | 3,162 |

| 9. Combes | 3,043 |

| 10. South Padre Island | 2,808 |

| 11. Santa Rosa | 2,779 |

| 12. Rio Hondo | 2,757 |

| 13. Rancho Viejo | 2,475 |

| 14. Palm Valley | 1,256 |

| 15. Los Indios | 1,058 |

| 16. Indian Lake | 830 |

| 17. Bayview | 397 |

| Unincorporated | 104, 875 |

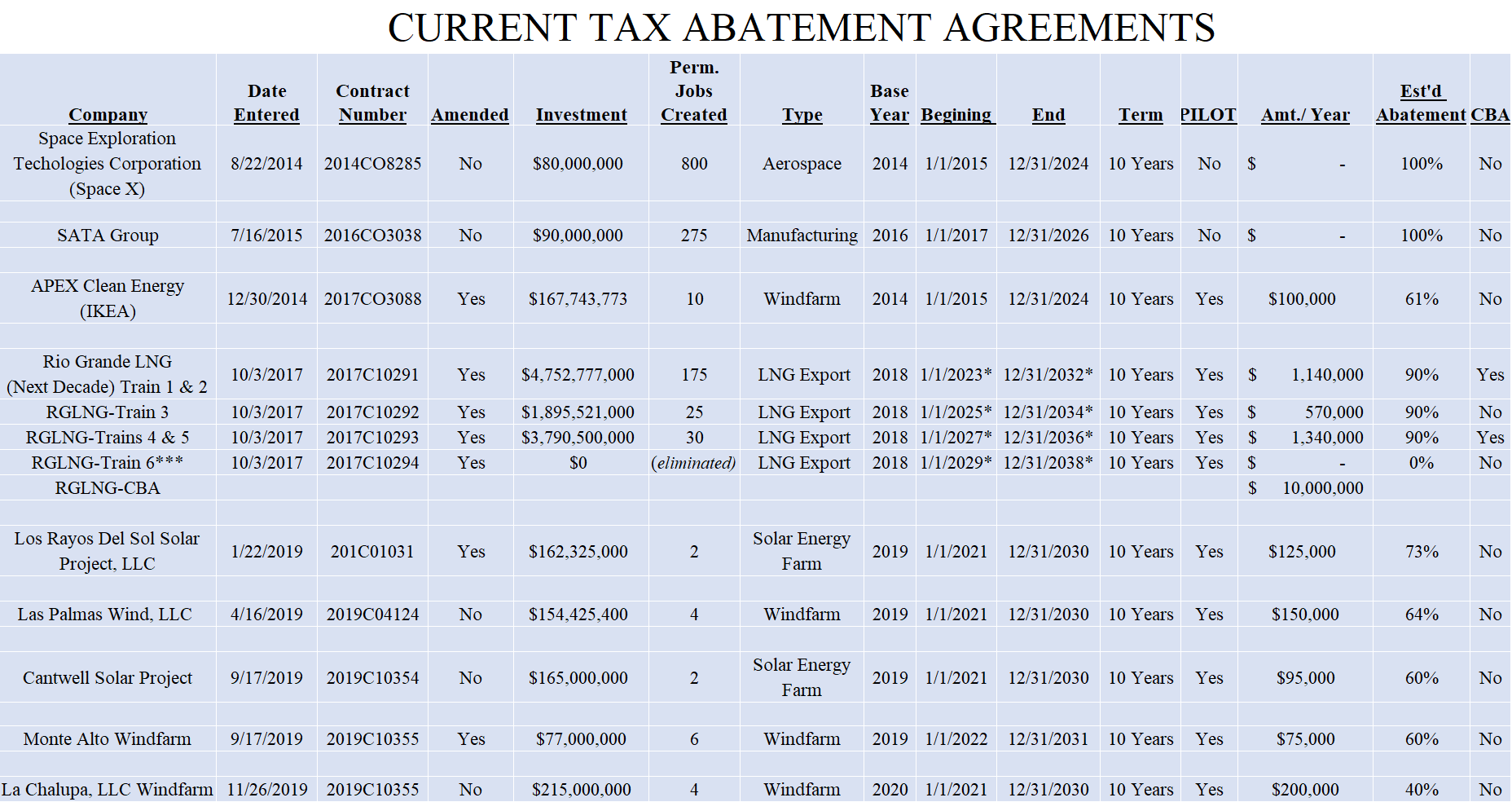

Tax Abatement Agreements

A tax abatement is a local agreement between a taxpayer and a taxing unit that exempts all or part of the increase in the value of the real property and/or tangible personal property from taxation for a period not to exceed 10 years. Chapter 312 of the Texas tax code created the ability for Texas jurisdictions to offer this incentive to developers.

Cameron County is an Economically Distressed County (EDC) – The Texas Administrative Code Chapter 176.01, allows economic incentives by local governments to induce private investment for the creation and retention of high quality jobs. Thus the entire county is treated as being designated as an enterprise zone.

To be qualified as an EDC, the4 following criteria must be met:

1.Poverty rate above 15.4%*

2.At least 25.4% of adult population does not have a high school diploma*

3.Unemployment rate remained above 4.9% during preceding years**

*Based upon latest U.S. Census

**Based upon Texas Workforce Commission

*** Rates (2015- 7.1%), (2016-7.2%), (2017-6.9%), (2018-6.1%), (2019-5.5%), (2020-12.2%)

Cameron County (2019)

—-25.5%

—-32.1%

—-05.5% ***

Tax Increment Reinvestment Zone

A tax increment reinvestment zone (T.I.R.Z.) is a political subdivision of a municipality or county in the state of Texas created to implement tax increment financing. They may be initiated by the city or county or by petition of owners whose total holdings in the zone consist of a majority of the appraised property value. Tax Code Chapter 311 governs tax increment financing.

The following steps are involved in the creation of a TIRZ:

1. Property owners possessing 50% or more of the appraised value of a district may submit a petition to the county, city, or town requesting a TIRZ be set up, or the city or county may decide to create one.

2. A specific lifetime for the TIRZ is determined.

3. A TIRZ may only be city-initiated if less than 10% of its land area consists of residential area.

4. For the purposes of existing tax-collecting entities (water districts, counties, etc.) the assessed values of properties within the new TIRZ are frozen. It is assumed that property values will increase over the lifetime of the TIRZ; the property taxes collected on this increase constitute the “increment”.

5. Local taxing authorities besides the creating organization negotiate for how much of the tax increment they will donate to the fund instead of keeping for themselves.

6. The municipality or county passes an ordinance establishing a governing board for the TIRZ and the zone as a legal entity itself. The board then meets to create a budget for the lifetime of the zone, establishing what projects it will undertake and how they will be financed. This plan is passed as another ordinance.

Cameron County has entered into participation agreements with cities of Brownsville, Harlingen, San Benito, Los Fresnos, Port Isabel, South Padre Island, and La Feria.

BROWNSVILLE:

City of Brownsville, “Santander” TIRZ #1, Passed City Commission October 5, 2004, passed County Commissioner’s Court December 21, 2004. Term began January 1, 2006. Term length – 15 years. County is participating at a 100% of new value. Total projected county contributions $3,068,659. County collections through 2019, $922,545. Located in the Morrison Road – Laredo Road area. Project includes road improvements, landscaping, Hike & Bike Trails, fencing and development costs.

City of Brownsville, “Amigoland” TIRZ#2, Cameron County did not participate

City of Brownsville, “Downtown” TIRZ#3, Cameron County did not participate

City of Brownsville, “Madeira Espiritu Santo” TIRZ#4, Passed City Commission on December 8, 2020. The County is still weighing the merits of the project. The TIRZ is requesting county participation of 50% of tax revenues from increment value increases for a 30-year term. The project is roughly 1,330 acres located on the south east portion beginning at the intersection of Highway 100 and US Highway 77/83. The project is seeking approximately $53.0 Million from county revenues to representing 38.5% of the funds to build an Arena, University complex, roads, trails, green spaces, parking and other public infrastructure.

HARLINGEN:

City of Harlingen “Loop 499” TIRZ#1, approved by City Commission on June 21, 2006. Approved by County Commissioners on July 19, 2012. Term for 15 years ending December 31, 2027. County participation is 100% of tax on increase value. Total estimated revenues $49,092,000 with maximum county participation capped at $9,862,00. Projects promised improvements included road upgrades of Washington Ave, Montezuma Road, 7th Street, Crosset Road, Rio Hondo Road, Grimes Road, Bob Youker Road and related sewer lines, drainage to include in-line water valves and fire hydrants. Amended on October 10, 2023, by the Commissioners’ Court to include the boundaries of Grimes Road.

City of Harlingen “FM 509” TIRZ#2, approved by the City Commission on June 21, 2006. Approved by the County Commissioners Court on July 19, 2012. Term is 15-years ending December 31, 2027. Participation is 100% of tax of increased value. Total projected contributions is $38,832,000 with the maximum county increment contribution totaling $7,448,000. Projects include Hale Ave, Whelen Rd., Turner Rd., Theme Rd., Nixon Rd. reconstruction, water line installation and upgrades, fire hydrants, sewer lines, force mains, and accompanying design and appurtenances.

City of Harlingen “West Spur 54” TIRZ#3, approved by the City Commission on June 21, 2006. Approved by the County Commissioners Court on July 19, 2012. Term is 15-years ending December 31, 2027. Participation is 100% of tax of increased value. Total projected contributions is $24,340,000 with the maximum county increment contribution totaling $4,710,000. Projects include land purchased for the Harlingen Convention Center, Road improvements to Teege Ave, Brazil Rd., Palm Crt., Tucker Rd., water line improvements and extensions, fire hydrants, and sewer improvements to Chester Park Rd., Rudd Rd., Teege Ave., Spur 54, Lincoln Ave., Bothwell Rd., and Midlane Drive including design costs and sewer appurtenances.

SAN BENITO TIRZ #1

Approved by City Commission on January 13, 2009. Approved by County Commissioners on July 9, 2009, Contract Nbr. 2009C07255. Term for 14 years ending September 1, 2023. County participation is 100% of tax on increase value. Total estimated revenues $9,538,000 with maximum county participation capped at $4,308,930. Parcels included are not contiguous being spread all over the city. Projects include Land Acquisition & Parking Improvements, Utility Relocations, Sewer System Enhancements, Street Reconstruction, Right of Way Acquisition, New Arterial & Collector Streets, Historic Preservation, Drainage Improvements, Municipal Fire Station, Municipal Museum, Airport Property Improvements, Sewer and Water Distribution Enhancements, Park Improvements, Economic Development Incentives totaling $48,250,000

LOS FRESNOS TIRZ #1

Approved by City Commission on December 17, 2013. Approved by County Commissioners on May 8, 2014, Contract Number 2014C05185. Term for 15 years ending December 31, 2029. County participation is 100% of tax on increase value. Total estimated revenues $8,447,935 with maximum county participation capped at $2,508,430. Projects include Street Extensions Commercial Development, Waterline Extensions Commercial Development, Matching Funds State and Federal Programs, Street Extensions & New Street Construction, Multifamily Construction, Sewer System Improvements, Water System Improvements, Park Construction and Improvements, Street Reconstruction Including Whipple Road and Henderson Road, and Drainage Improvements all totaling $34,733,367

SOUTH PADRE ISLAND TIRZ #1

Approved by City Commission on January 13, 2013. Approved by County Commissioners on May 8, 2016, Contract Nbr. 2016C03068. Term for 11 years ending December 31, 2026. County participation is 75% of tax on increase value. Total estimated revenues $8,207,478 with maximum county participation capped at $3,908,271. Projects include Padre Boulevard, Sidewalks, Drainage, Landscaping, Medians, and Utilities all totaling $12,500,000

LA FERIA TIRZ #1

Approved by City Commission on March 25, 2008. Approved by County Commissioners on May 6, 2008, Contract Nbr. 2008C05150. Term for 29 years ending December 31, 2036. County participation is 50% of tax on increase value. Total estimated revenues $26,990,018 with maximum county participation capped at $5,294,078. Projects include Land Acquisition, Sewer Plant expansion, sewer line extension, drainage improvements, Economic Development Incentives, Destination Recreational Facilities, Regional Parks, Swimming Facilities, Public Safety Facilities, Municipal Facilities, Educational/Job-training Facilities and Residential Development Incentives all totaling $51,450,000.

PORT ISABEL TIRZ PIPID#1

Approved by City Commission on February 15, 2012. Approved by County Commissioners on December 20, 2012, Contract Nbr. 2012C12544. Term for 15 years ending December 31, 2027. County participation is 100% of tax on increase value. Total estimated revenues $8,329,049 with maximum county participation capped at $2,632,475. Projects include construction of Boulevard Port Road to Hwy 48, Street, Water, and Sewer Extensions, Multi-Family Property Acquisition, Streetscape Hwy 100, Public Housing Enhancements, and Public Facilities totaling $13,375,000.

PORT ISABEL TIRZ #1 (Modern Venice)

Approved by City Commission on August 16, 2011. Approved by County Commissioners on July 11, 2017 Contract Nbr. 2017. Term for 26 years ending December 31, 2042. County participation is 75% of tax on increase value. Total estimated revenues $16,739,067 with maximum county participation capped at $4,995,893. Projects include construction of seawalls, streets, tide breakwater structure, dredging, sewer lines and lift station, engineering, water lines, street landscaping, and paving totaling $16,945,000.

CAMERON COUNTY ECONOMIC ASSETS

LOCATION

We are on the front door with Mexico, and next to the Gulf of Mexico

COST OF LIVING

Cameron County is a low tax environment. The Cost of Living Index is 72.5 where 100 is the U.S. Average.

CLIMATE

The county experiences on average 227 sunny days a year(U.S. avg. is 205), on 71 days there is some type of precipitation, however, rain events can be heavy in the spring. The county averages 27 inches of rain. The remaining 67 days are cloudy to partly cloudy. Summer time highs in July are around 94 degrees, and January lows can average 51 degrees. It snowed once on December 24th, 2004, once in over 100 years. Proximity to the Gulf of Mexico results in higher than normal humidity, and winds are usually constantly over 10 mph, and sometime gusty in the spring.

CROSSINGS

Four International Bridge crossing into Mexico with dedicated commercial lanes with close proximity to Foreign Trade Zone Nbr. 62 anchored at the Port of Brownsville. This Foreign Trade Zone Ranks Number 2 in the U.S. for Value of Exports for the eighth year in a row with more than $4.3 billion in exported goods in 2019, an increase from the $3.8 billion reported in 2018.

SEA PORTS

One deep-water port of the Port of Brownsville and two intra-coastal canal ports in Harlingen and Port Isabel.

AIRPORTS

Thee long runway airports, two commercial airports at Harlingen(8,301 ft.)and Brownville(7,399 ft), and a general aviation airport located just north of Laguna Vista(8,001 ft).

ECONOMIC INCENTIVES

Freeport Tax Exemptions (Sections 11.251, 11.437 and 11.253, Tax Code and Article 8, Sec. 1-j of the Texas Constitution), Tax Abatements (Tax Code Chapter 312), Tax Increment Reinvestment Zones (Tax Code, Chapter 311), 16 Opportunity Zones(Tax Cuts and Jobs Act of 2017) and Foreign Trade Zone #62 ((19 U.S.C. 81a-81u), and (15 CFR part 400)).